Commercial P&C agencies don’t lose time because people “aren’t working hard enough.” They lose time because the work is high-volume, high-interruption, and scattered across internal software, PDFs, emails, carrier portals, third party integrations, and renewal checklists. In Quickfire, working with your data stops feeling like a scavenger hunt and starts feeling like mission control for your agency.

Responses stream in live with visual intent badges so you can instantly see whether the assistant is answering a question, running a data lookup, or triggering an action. When you want hands-free speed, voice input turns spoken requests into instant results, while built-in task actions can launch emails or calls without breaking the flow. And what makes it feel truly groundbreaking is the trust layer: every answer can expand into transparent, data-backed results with supporting context. Instead of black-box AI, Quickfire surfaces the “why” behind the answer with clean, readable details and semantic hints that bridge business language to real agency data.

Personalized Data Means Polished Responses

If you’ve ever seen an “AI in insurance” demo, you’ve probably noticed the big breakthrough they’re selling is: “You can ask a chatbot questions.” Cool. So can everyone else. The difference is whether the system can answer using your documents, your activity history, your renewal pipeline, and your carrier relationships.

How It’s Done in Quickfire

Quickfire retrieves facts and metrics from your AMS/database (clients, policies, renewals, premiums, tasks, submissions), data from your files (quotes, applications, loss runs, endorsements, contracts), and text from recent activities via APIs (call transcripts, emails, payments, e-signatures) to power its capabilities using semantic search + RAG. With relevant context, it can navigate you to sources, answer questions with precision, and trigger agent actions like drafting emails, generating renewal tasks, assembling submissions, building proposals, and more.

Retrieval-Augmented Generation answers by pulling relevant source material first, then generating from that context. Ask: “Which policies for APEX Builders’ have Primary & Noncontributory wording?” and get a grounded answer tied to your stored contract language.

Vector search (SQL Server 2025 or Qdrant) finds records by meaning, not just keywords. Translation: “find the thing” becomes instant, even when it’s buried inside a 47-page PDF.

Actions turn intent into execution: run workflows, generate tasks, draft emails, assemble packages, produce summaries, and keep everything tracked so work stops living in people’s heads.

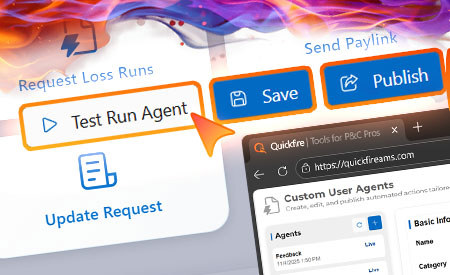

Quickfire does

- Finds the insured, relevant WC policies, and effective dates.

- Pulls carriers and loss-run request instructions linked to those policies/renewals.

- Drafts carrier-specific emails and steps for sources it can’t access (portals, phone departments).

- Sends, tracks, attaches, and follows up (via Microsoft Graph patterns).

- Logs tasks/status in the renewal so it’s not a “tribal memory” event.

Unlocking the Potential

Below are examples of real-world prompts that map to commercial P&C workflows. These are the kinds of questions people want answered but usually can’t justify the time to compute. With Quickfire, it’s a simple conversation between you and your data.

The Real Punchline

Quickfire isn’t just another AI toy you ask questions to. It was built on an open-source core with powerful integrations and a feature-rich platform designed specifically for commercial P&C broker workflows.

When you talk to your data inside Quickfire, you’re not searching blind. You’re interacting with:

- Your structured book – renewals, policies, premiums, tasks, submissions

- Your unstructured truth – PDFs, endorsements, contracts, loss runs, emails, call transcripts

- Workflow automation that turns “ask” into “done” – drafted emails, assembled packages, summaries, next steps, reminders

That’s the real difference between “AI answers questions” and “AI removes friction from commercial P&C operations.”

Quickfire doesn’t just give answers. It eliminates the busywork that has defined agency pain for decades, freeing teams to focus on strategy, relationships, and growth.